Who is Revenue Share Digital For?

I partner exclusively with a small number of serious, ambitious ecommerce stores and service based businesses (£3K AOV+) such as Driveways, Roofing, Windows & Doors, Rendering & Coatings, Solar Panels, Garden Rooms, Loft/Garage Conversions, Landscaping and Fencing/Decking and want a true marketing partner — I'm someone who doesn’t just generate sales and leads, but who shares in the risk, the work, and the upside. I can only work with a select number of businesses at any one given time. Please check below to see if your business is eligible.

How I Generate Leads on Autopilot

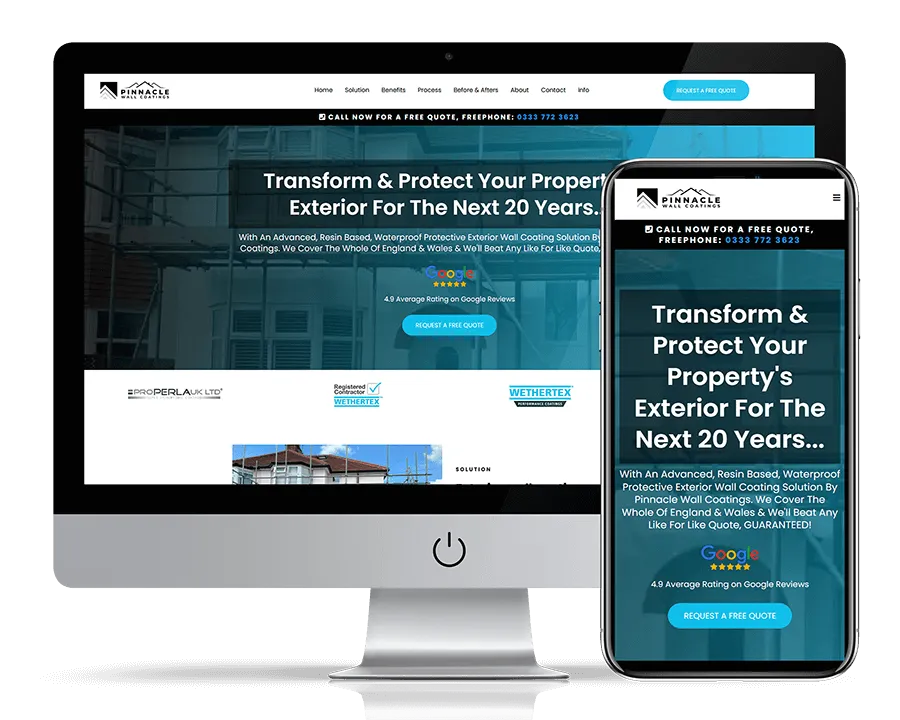

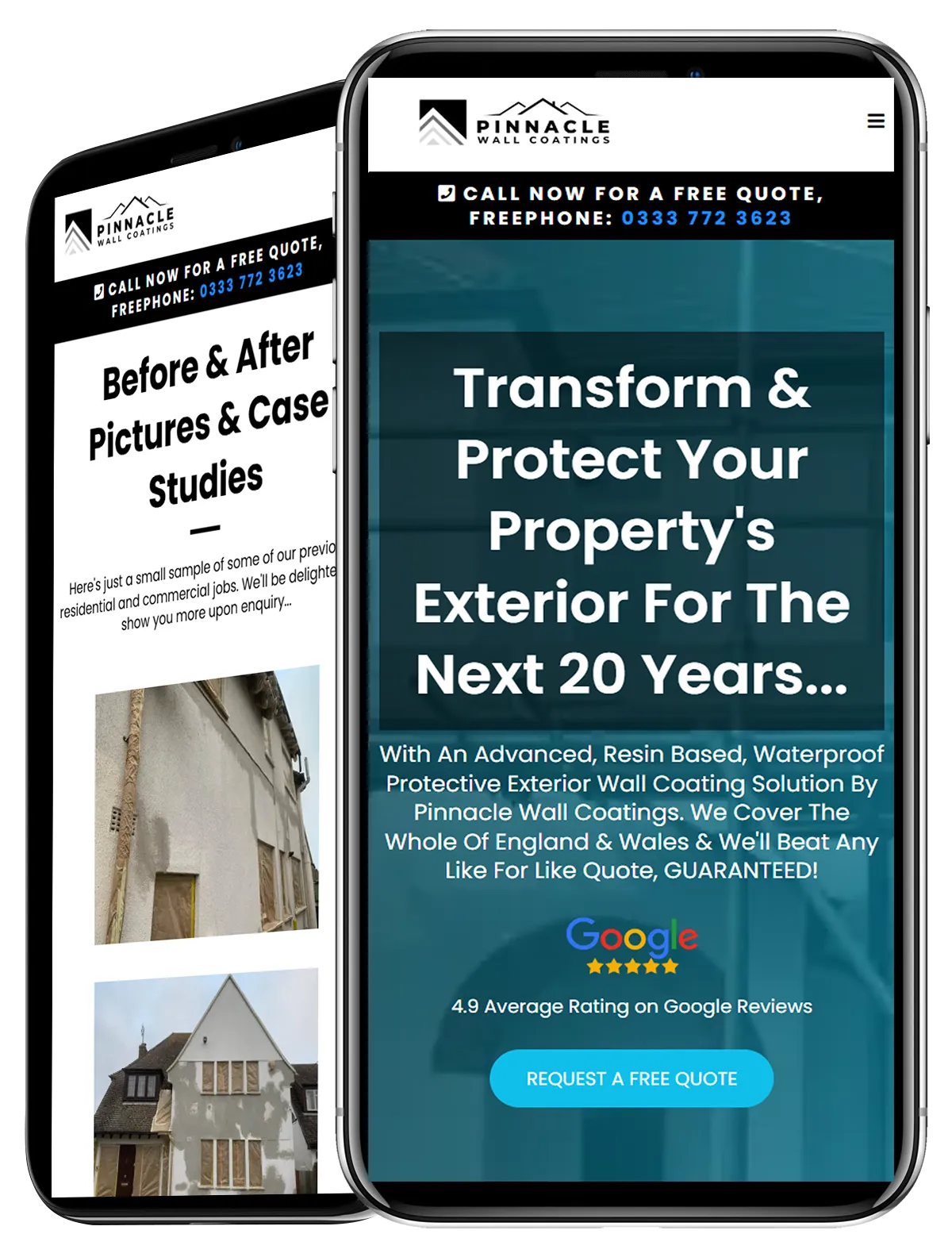

Step 1 - High-Converting Sales Funnel

I'll design, build, host and manage high converting sales funnel for your business that turns visitors into sales.

I'll use the exact same high-converting funnel templates that I've used to generated over $3M worth of business over the last few years.

No more static 'brochure-style' websites that don't generate laser focused, highly-qualified leads.

You'll get a high converting sales funnel and website that generates

leads on auto-pilot.

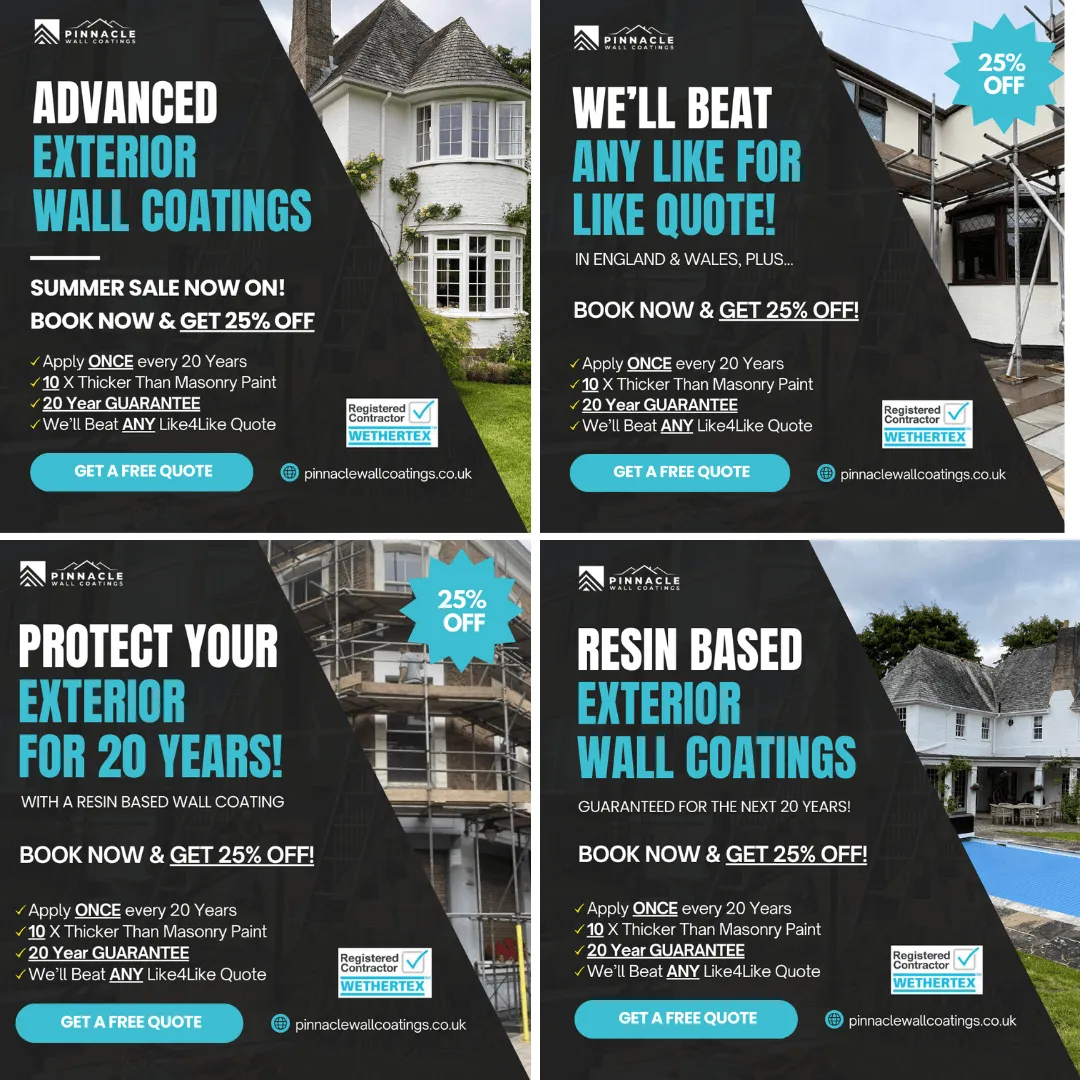

Step 2 - Laser Targeted Traffic

I'll build, manage and optimise a series laser targeted SEO, Google Ads, Meta Ads, Organic Social & Automated Email campaigns to maximise your exposure across all relevant channels to attract a steady flow of highly qualified leads.

- Google Search

- Google Ads

- Facebook Ads

- Instagram Ads

And wherever else your target audience hangs out online.

Case Studies

I can't guaranteed these results for you but it shows what could happen.

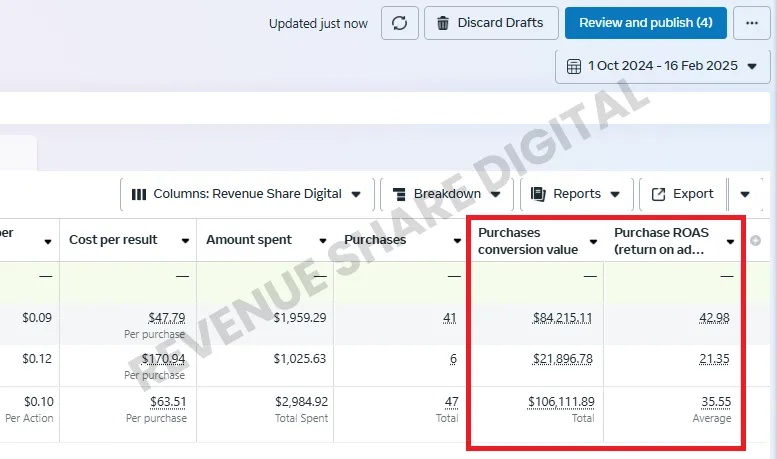

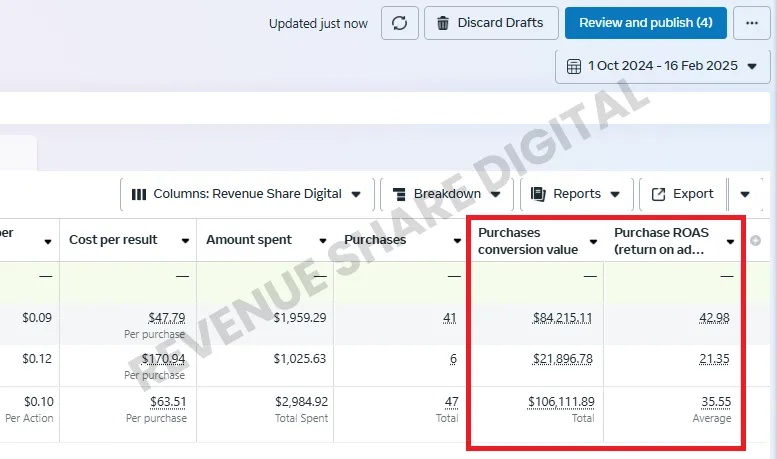

CASE STUDY

A Technology Store Has Increased Revenue by 106.1K in Just 4 Months With a 3550% ROAS

CASE STUDY

A Technology Store Has Increased Revenue by 106.1K in Just 4 Months With a 3550% ROAS

CASE STUDY

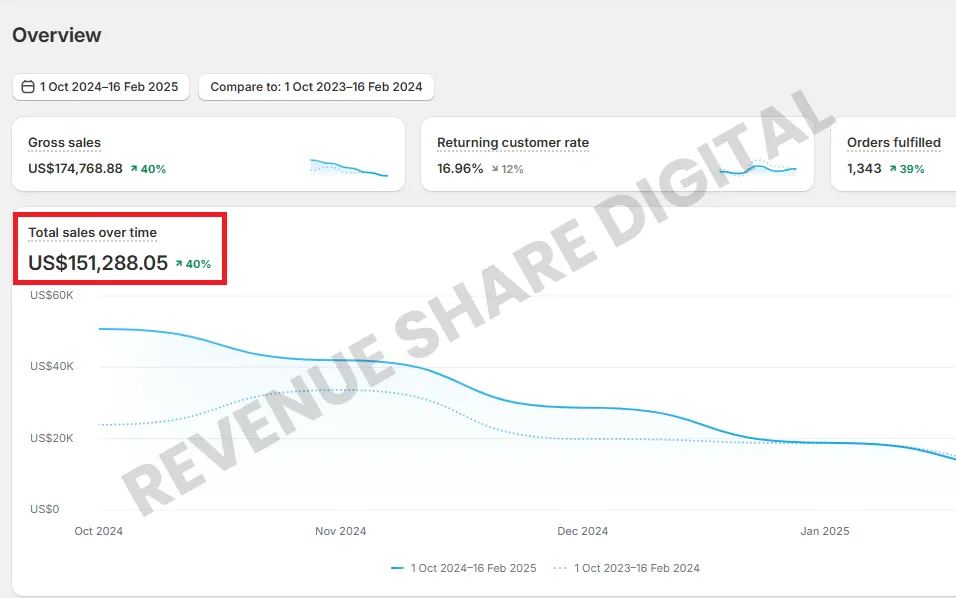

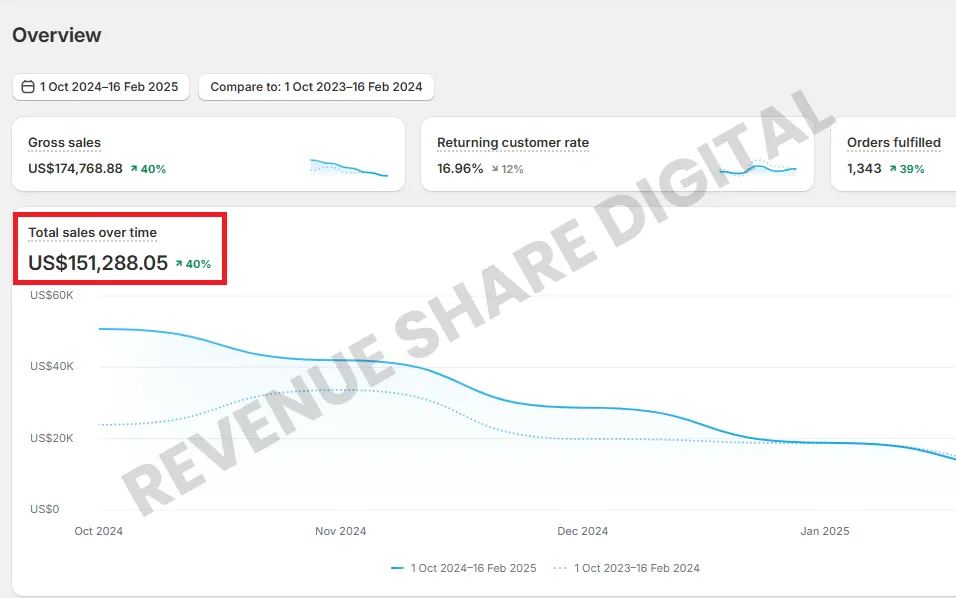

A Clothing & Apparel Store Has Increased Total Revenue by 40% in Just 4 Months

CASE STUDY

A Clothing & Apparel Store Has Increased Total Revenue by 40% in Just 4 Months

CASE STUDY

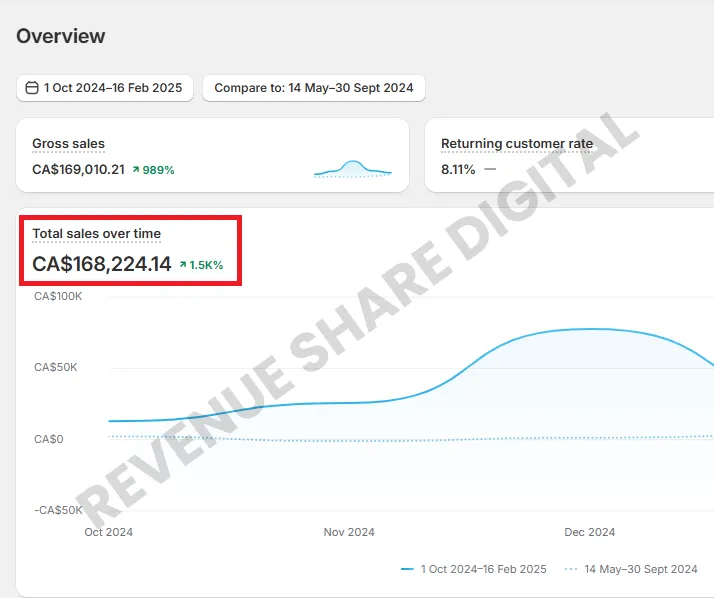

An Electronics Store Has Increased Increased Total Revenue By 1500% in 115 Days

CASE STUDY

An Outdoor Living Company Has Gone From £17K/pm To £82.6K/pm in 142 Days

CASE STUDY

An Outdoor Living Company Has Gone From £17K/pm To £82.6K/pm in 142 Days

Step 2 - Laser Targeted Traffic

I'll build, manage and optimise a series laser targeted SEO, Google Ads, Meta Ads, Organic Social & Automated Email campaigns to maximise your exposure across all relevant channels to attract a steady flow of highly qualified leads.

- Google Search

- Google Ads

- Facebook Ads

- Instagram Ads

And wherever else your target audience hangs out online.

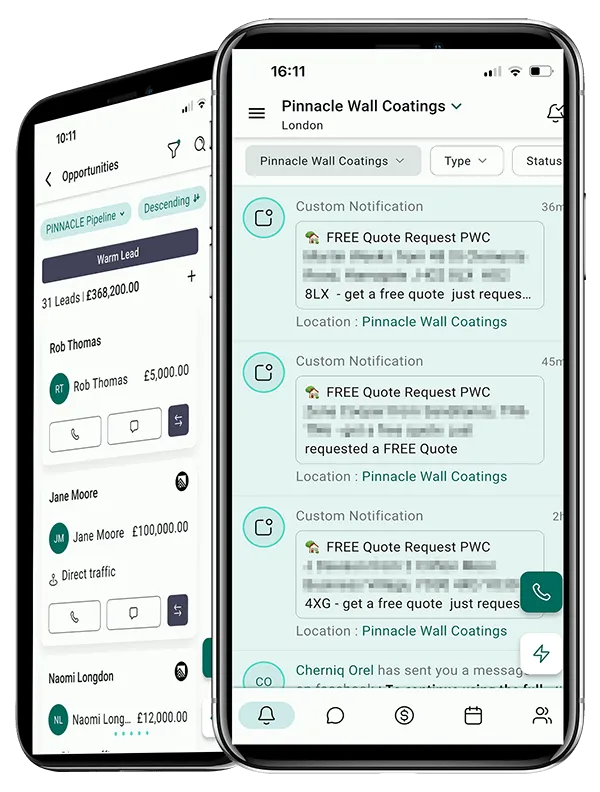

Step 3 - Lead Notifications

I'll design, build, host and manage high converting sales funnel for your business that turns visitors into sales.

I'll use the exact same high-converting funnel templates that I've used to generated over $3M worth of business over the last few years.

No more static 'brochure-style' websites that don't generate laser focused, highly-qualified leads.

You'll get a high converting sales funnel and website that generates

leads on auto-pilot.

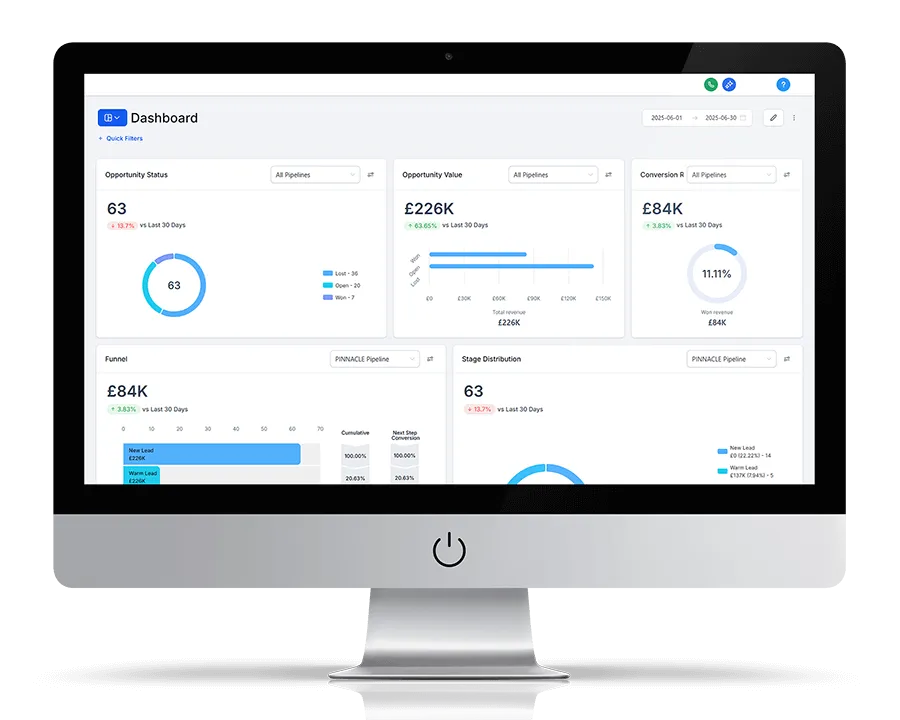

Step 4 - Performance Managment

I'll build, manage and optimise a series laser targeted SEO, Google Ads, Meta Ads, Organic Social & Automated Email campaigns to maximise your exposure across all relevant channels to attract a steady flow of highly qualified leads.

- Google Search

- Google Ads

- Facebook Ads

- Instagram Ads

And wherever else your target audience hangs out online.

Step 4 - Performance Management

I'll build, manage and optimise a series laser targeted SEO, Google Ads, Meta Ads, Organic Social & Automated Email campaigns to maximise your exposure across all relevant channels to attract a steady flow of highly qualified leads.

- Google Search

- Google Ads

- Facebook Ads

- Instagram Ads

And wherever else your target audience hangs out online.

Step 5 - Scaling & Optimisation

We work together and I scale and optimize marketing budget for consistent and predictable sales growth.

Instead of burning money on marketing, let me build you a scalable, automated customer acquisition machine that works even while you sleep and only costs you when you close leads.

Case Study

From £17K To £100K+ Per Month In Just 3 Months

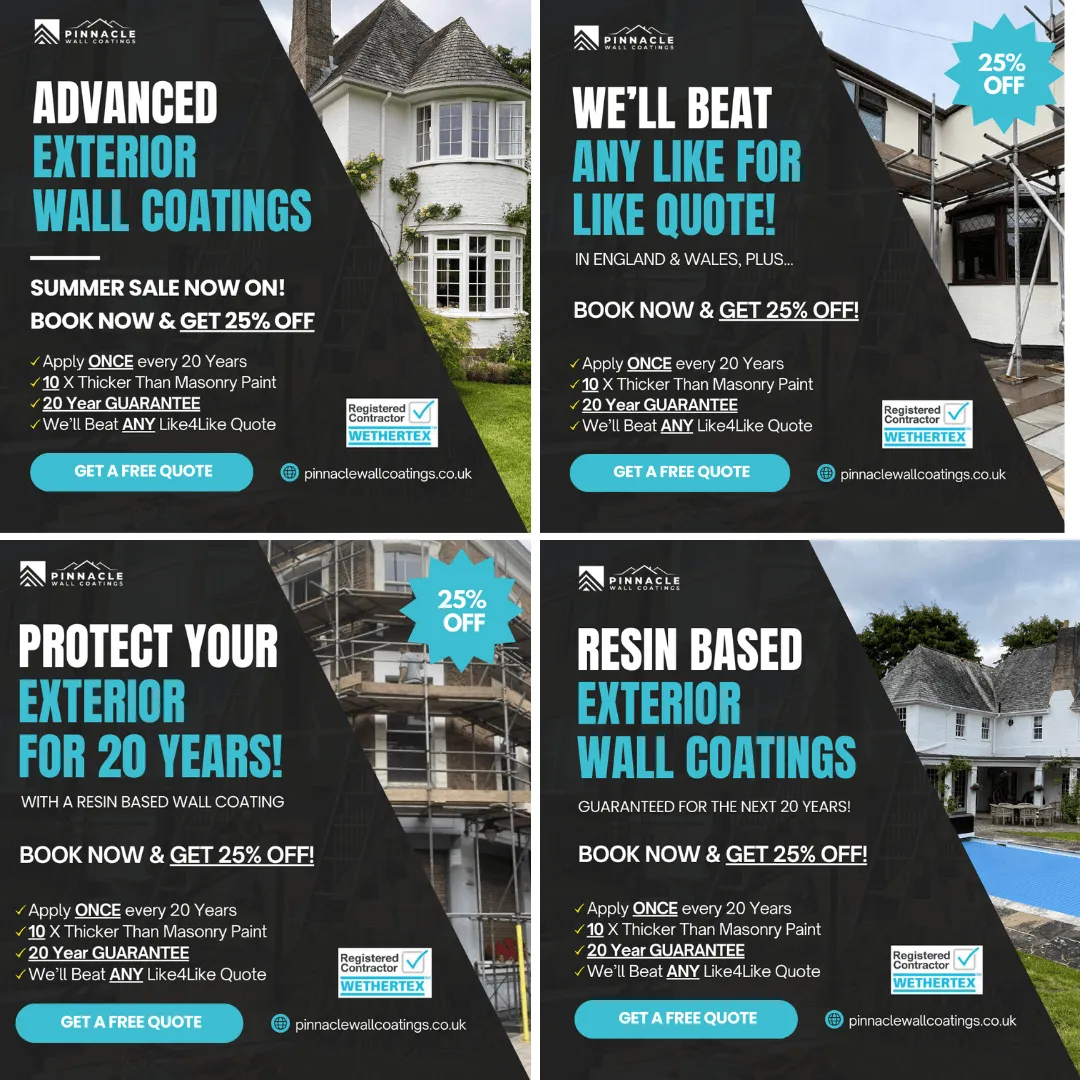

Company: An exterior wall coating company covering the whole of England & Wales.

Problem: Low converting WordPress website and had tried multiple agencies and so called experts at great expense with no success in generating leads whatsoever.

Solution: High converting sales funnel and nationwide lead generation solution with expert SEO, Google and Meta/Facebook ads optimisation and management.

Payment Option: Revenue Share

Results: 623.5% YOY Monthly Revenue Growth. Blended revenue ROAS of 2080%

"Exceptional Results"

Working with RSD completely transformed the way we win leads and new business. Before, we were stuck in a vicious circle of trying and failing with multiple agencies and inconsistent enquiries.

Within weeks of partnering, we started receiving a steady flow of high-quality, exclusive leads that were actually ready to buy—not just tyre kickers. The transparency, honesty, and attention to detail have been second to none.

What really stands out is the ROI. For every pound we’ve invested in marketing, we’ve seen many times that back in confirmed jobs.

We’ve closed projects we never would have reached without this and have added six figures to our monthly turnover.

If you’re serious about growing your business, this isn’t just another ‘lead gen service’—it’s a true partnership. RSD delivers exactly what it promises, and I honestly can’t recommend this partnership highly enough."*

— J. Jackson, Partner - Pinnacle Wall Coatings

Buy High-Volume Motor Vehicle Accident

(MVA) Leads — Nationwide.

Built for Law Firms Buying at Scale.

Deploy $50,000+ monthly MVA acquisition campaigns backed by proven nationwide benchmarks — without shared funnels, CPL volatility, or inventory caps.

- $40M+ deployed across US MVA campaigns

- 15% average close rate nationwide

- Typical case cost = $2,000 - $2500

⭐⭐⭐⭐⭐ Trusted by 750+ Law Firms Across The US & Over $1Billion in Case Revenue Generated

Built for Firms That Already Buy Volume.

This platform is designed for established personal injury law firms that already understand paid acquisition, intake throughput, and downstream case value.

A strong fit if:

01

You actively practice MVA / PI law

This platform is built specifically for firms where MVA cases are a core revenue driver, not a side practice.

Campaigns are optimised around real accident demand, intake velocity, and downstream case value — not generic PI traffic or mixed practice areas.

If MVA is not a primary focus, the economics won’t align.

02

Your firm has 20+ employees or a dedicated intake team

High-volume acquisition only works when intake can keep pace.

This model assumes:

- Calls are answered live (at least 6 days per week)

- Follow-up happens fast

- Leads are worked consistently

Firms with internal intake teams (or outsourced intake) are able to:

- Convert higher percentages of inbound leads

- Maintain stable close rates at scale

- Accurately evaluate performance by case outcomes

Without this infrastructure, even good leads underperform.

03

You already buy leads or run paid media

This platform is designed for firms that already understand acquisition volatility.

You should be comfortable with:

- Daily fluctuations in CPL

- Learning periods and optimisation cycles

- Attribution lag between lead, intake, and signed case

If you’ve previously invested in paid traffic or lead buying, you’ll immediately recognise why this model exists — and why small tests rarely tell the full story.

04

You evaluate acquisition by cost per signed case

This is critical.

Campaigns are not optimised for lead count or headline CPL. They are optimised for signed cases at scale. We typically average $2,000-$2,500 CPC (Cost Per Case) nationwide.

Firms that succeed with this model:

- Track case outcomes

- Understand lifetime case value

- Accept that CPL will fluctuate while case cost remains stable

- Make scaling decisions based on real downstream data

If your internal reporting stops at “cost per lead,” this won’t be the right fit.

04

You can deploy $50k–$100k+ monthly budgets

Meaningful MVA acquisition requires enough spend to generate signal.

At this budget range:

- Platforms optimise faster

- Performance stabilises

- Intake variance smooths out

- Case economics become predictable

Underfunded campaigns create noise, not insight — which is why we set a $50,000 minimum to protect performance on both sides.

05

In short...

This platform is built for firms that already:

- Buy acquisition seriously

- Understand scale economics

- Prioritise case outcomes over vanity metrics

If that sounds like your operation, we should talk.

Why Traditional MVA Lead Models Break at Scale.

Traditional MVA lead models don’t fail because of execution issues — they fail because they are structurally unsound at scale. Shared funnels dilute lead quality, expose buyers to CPL volatility during competitive or seasonal swings, and incentivise vendors to quietly throttle volume to protect margins.

As spend increases, credit disputes replace optimisation, and small-budget “tests” generate misleading data that leads firms to make the wrong decisions.

These are not problems that can be fixed with better optimisation — they are inherent flaws in transactional, shared-lead models that were never designed to support sustained, high-volume MVA acquisition.

A Dedicated 'Media-Buy' Model Built for Scale

Instead of selling access to a shared funnel, we operate state-specific MVA acquisition campaigns designed to support sustained spend and predictable outcomes.

What this means in practice:

Each campaign is dedicated at the state level.

Your budget directly funds acquisition.

Optimisation is focused on case outcomes, not lead inflation.

Volume is not artificially capped.

Scaling decisions are driven by real performance data.

No long term contracts that get you stuck.

MVA Acquisition Infrastructure — Not “Leads”

Access owned digital demand infrastructure (fully compliant state-wide) across the US. You are not buying a list. You are buying access to proven acquisition infrastructure.

Real-time Inbound MVA Calls & Forms

State-level Campaign Segmentation

Exclusive Acquisition Paths (no recycled data)

Open Buyer Model Built For Volume

Centralised Quality

Control

This allows us to secure better pricing, faster deployment, and more consistent performance than buyers can achieve sourcing leads individually. You work with one team, one system, and one point of accountability — while we handle sourcing, optimisation, and supply management behind the scenes.

United States

Canada

United Kingdom

Australia

Proven At National Scale.

Our MVA acquisition systems have been deployed across $40M+ in paid media, supporting campaigns for some of the largest personal injury firms in the U.S.

These campaigns have been refined across:

- Highly competitive jurisdictions

- Sustained, high-spend environments

- Long-run optimisation cycles

- Real intake constraints

What this means for new campaigns:

Benchmarks already exist.

Media buys do not “start cold”.

Conversion assumptions are data-driven

Spend can be deployed faster without destabilising performance

Early-stage volatility is absorbed, not passed to the buyer

Creative, funnel, and routing assumptions are pre-validated

Growth decisions are supported by repeatable economics

Economics That Experienced MVA Lead Buyers Expect.

MVA acquisition only works when economics are evaluated downstream, not at the lead level. While results vary by state, competition, and intake execution, campaigns are benchmarked against nationwide performance data drawn from sustained, high-volume MVA spend — not short tests or best-case projections.

Typical benchmarks include:

01

15% Close Rate (US)

At scale, MVA campaigns stabilise around a 15% close rate when intake is consistent and volume is sufficient. This reflects real-world performance across competitive U.S. markets, factoring in normal variation in traffic quality, response times, and follow-up — not idealised conditions or short-term tests.

02

$2K-$2.5K Case Cost

A $2,000 - $2.5K case cost represents sustainable, all-in acquisition at scale, absorbing normal CPL volatility and seasonal swings. It reflects outcome-level performance where experienced buyers measure success — at the signed case, not the lead.

Nationwide Reach. State-Specific Execution.

MVA acquisition does not scale uniformly across the U.S., which is why campaigns are structured and executed on a state-by-state basis.

Each market is treated independently to account for differences in media costs, competitive density, regulatory requirements, and jurisdiction-specific intake and routing considerations.

This approach allows acquisition to scale where conditions support it, while maintaining control and predictability in more complex or competitive states.

What You Actually Get.

When you work with us, you’re not buying generic enquiries, shared funnels, or recycled form fills. You’re accessing real-time MVA demand generated from dedicated digital acquisition assets, built and optimised specifically to support high-volume intake environments.

Every campaign is structured for firms with the operational maturity to convert inbound accident demand into signed cases — not for casual lead buyers or low-capacity practices.

Once a lead is delivered, it is yours to convert.

No reselling. No redistribution. No dilution.

01

Exclusive MVA Leads

Every lead is delivered to a single firm only. Leads are never shared, resold, or recycled across buyers. Once delivered, the opportunity is yours alone.

02

Buyer-Defined Filters

Campaigns are configured around pre-agreed qualification criteria, including jurisdiction, accident type, intent signals, and any exclusion rules required for your practice. This ensures alignment before traffic is scaled.

03

High-Intent Accident Demand

Leads are generated from assets designed to capture users actively seeking legal help after an accident — not cold traffic, awareness clicks, or casual browsers. Intent is built into the acquisition, not filtered afterward.

04

Real-Time Delivery

Leads are delivered instantly to your CRM, webhook, call routing system, or intake provider. This supports: Faster response times, Higher contact rates, More predictable close performance.

05

Scalable Volume Control

Increase volume, reduce delivery, or cap daily flow based on: Intake capacity, Performance, Internal workload. You control scale — not a marketplace algorithm.

06

Quality Protection at Scale

You only receive leads that meet the qualification framework agreed upfront. As volume increases, criteria are enforced — not relaxed — protecting downstream case economics.

07

No Lock-Ins, No Retainers

There are no long-term marketing contracts or retainers. Access to acquisition capacity continues based on: Performance, Commercial alignment, Operational fit. This keeps incentives clean on both sides.

08

Centralised Accountability

One system. One acquisition framework. One point of accountability for lead generation, routing, and quality. No finger-pointing. No fragmented vendors.

How it Works.

This model is designed for buyers who understand paid acquisition and want predictable lead volume without building or managing internal media infrastructure.

You fund the media budget. We build, operate, and optimise the acquisition engine.

We handle campaign architecture, traffic acquisition, qualification logic, and routing. You receive inbound leads generated from those campaigns and close them through your existing intake process.

Spend is allocated directly to media, not inflated retainers or bundled fees.

01

Define Target Markets & Intake Criteria

We align upfront on the states, case types, volume targets, and qualification requirements that define a valid lead for your business.

This includes geographic coverage, media constraints, intake rules, and any exclusions that affect downstream performance.

Clear criteria ensure traffic quality, delivery standards, and expectations are set before spend is deployed.

02

Media Is Deployed & Actively Managed

Your budget is deployed directly into paid acquisition across approved channels.

Campaigns are structured on a state-by-state basis to account for cost variance, competition, and regulatory requirements.

We manage optimisation, scaling, and spend allocation continuously to maintain efficiency and consistency as conditions change.

03

Leads Are Delivered in Real Time

Inbound leads generated from the campaigns are delivered directly to your intake team.

You control follow-up, qualification confirmation, and case conversion.

Performance is measured on lead delivery and downstream outcomes — not impressions or vanity metrics.

04

You’re Paying for Media Execution — Not Overhead

There are no retainers or long-term contracts.

You’re not paying for internal teams, tools, or unused capacity.

Your investment goes into traffic acquisition and execution — with full transparency into how budget is deployed.

Media Buying Model vs. Traditional Pay-Per-Lead

Media Buying Model

Traditional Pay-Per-Lead Model

Cost Structure

Fixed media budget

Variable cost per lead with embedded margins

Budget Control

Full control over monthly spend

Spend fluctuates based on lead volume and vendor pricing

Where Money Goes

Budget deployed directly into paid media

Significant portion absorbed by reseller margin

Lead Volume

Scales predictably with spend

Inconsistent and often capped

Lead Cost Stability

Scales predictably with spend

Inconsistent and often capped

Market Control

State-by-state execution with defined coverage

Vendors prioritise easiest or cheapest markets

Exclusivity

Leads are generated for your campaigns

Leads are often shared, recycled, or resold

Quality Control

Qualification criteria set upfront

Quality defined by vendor, not buyer

Scaling Logic

Scale where economics support it

Scale constrained by vendor inventory

Incentive Alignment

Aligned on efficiency and downstream outcomes

Incentivised on volume, not performance

The difference isn’t tactical — it’s structural. One model sells leads. The other builds and operates demand.

Start With a Controlled Initial Trial.

Before scaling, campaigns begin with a controlled initial deployment designed to validate performance under real operating conditions.

Typical initial commitment: $50K.

This phase exists to confirm that demand, intake flow, and case economics align with your firm’s expectations before increasing volume or expanding into additional states. It is not a proof-of-concept — it is a structured validation period.

Lead quality under real intake conditions

Intent strength at meaningful volume

Delivery speed into your intake workflow

Fit with your internal sales and follow-up process

Following the initial deployment, pacing and structure can be adjusted based on performance, intake capacity, and commercial fit. This may include increased volume, adjusted delivery parameters, or expanded state coverage.

The objective is simple: predictable, scalable inbound MVA demand (cases at $2K - $2.5K) — without unnecessary risk on either side.

Frequently Asked Questions.

01

Who is this service designed for?

This service is built for established personal injury law firms where MVA cases are a core revenue driver.

It’s best suited to firms with dedicated intake capacity that already buy leads or run paid acquisition and can deploy meaningful monthly budgets.

This service is built for established personal injury law firms where MVA cases are a core revenue driver. It’s best suited to firms with dedicated intake capacity that already buy leads or run paid acquisition and can deploy meaningful monthly budgets.

02

Is there a minimum commitment?

Yes. The minimum initial deployment is usually $50,000. This ensures campaigns generate enough volume to produce reliable performance data and avoids the misleading results that come from underfunded tests.

03

Is this a pay-per-lead model?

No. Campaigns are structured as dedicated media buys, not transactional pay-per-lead purchases.

Performance is evaluated on signed cases, not raw lead volume or headline CPL.

04

Are the leads exclusive?

Yes.

Every lead is delivered to a single firm only. Leads are never shared, resold, or distributed across multiple buyers.

05

Are leads delivered in real time?

Yes.

Leads are delivered instantly via call routing, CRM integration, webhooks, or intake providers to support immediate follow-up and higher conversion rates.

06

What types of MVA cases do you generate?

Campaigns focus on motor vehicle accident demand, including car, truck, and related injury cases.

Specific filters and exclusions can be applied based on your practice and jurisdiction.

07

What close rates should we expect?

Across U.S. markets, campaigns typically average = 15% close rates when intake is consistent and volume is sufficient.

Actual performance varies by state, competition, and follow-up execution.

08

What is a typical cost per signed case?

At scale, firms typically see case costs around $2,000, factoring in normal CPL volatility and seasonal variation.

Performance is evaluated on long-run case outcomes, not short-term fluctuations.

09

How long does it take to evaluate performance?

Meaningful evaluation requires sufficient volume.

Most firms can assess performance trends within the initial deployment period (usually 30 days), with clearer signal emerging as volume increases.

10

Can we control volume and pacing?

Yes.

Volume can be increased, reduced, or capped based on intake capacity, performance, and internal workload. Scaling decisions are data-driven, not inventory-limited.

11

Do you operate nationwide?

Yes.

Campaigns are structured on a state-by-state basis to account for media cost variance, competitive density, and regulatory requirements.

Availability is managed to protect performance.

12

How do you handle compliance?

Campaigns are structured to meet state-specific advertising and disclosure requirements, including jurisdictions with stricter regulatory frameworks.

Compliance is built into campaign setup, not retrofitted later.

13

Are there long-term contracts or retainers?

No long-term marketing retainers are required.

Continued access to acquisition capacity is based on performance, commercial alignment, and operational fit.

14

What happens after the initial deployment?

After the initial phase, campaigns may scale in volume, expand into additional states, or adjust pacing and structure based on performance and intake capacity.

15

What do you need from us to succeed?

Successful firms have live intake, disciplined follow-up, and internal reporting focused on signed cases.

Lead quality and conversion performance are shared responsibilities.

16

Is this suitable for firms new to MVA advertising?

No.

This platform is designed for firms with existing MVA operations and acquisition experience.

Firms new to MVA typically lack the intake capacity and budget required for this model to perform predictably.

17

Who Are We?

We're a small senior team of elite digital marketing and growth consultants in the legal space with over 20 years experience of high-volume supply.

Over the years, we have built up an exclusive network of experienced operators and market leaders in this space.

This allows us to scale assets intelligently without bloating the business.

We’ll cover all the details if there’s a strong fit.